- EAN13

- 9782312003160

- Éditeur

- OFCE

- Date de publication

- 14 novembre 2012

- Nombre de pages

- 448

- Dimensions

- 22,5 x 15 x 2,4 cm

- Poids

- 610 g

- Langue

- eng

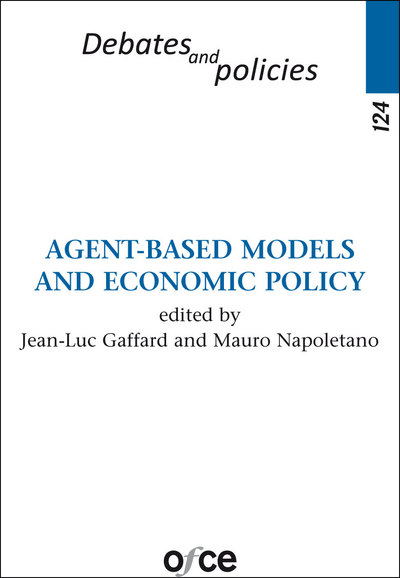

N°124 - Debates And Policies: Agent-Based Models And Economic Policy

Jean-Luc Gaffard, Mauro Napoletano

OFCE

Prix public : 22,00 €

Résumé : Many of the factors responsible for the financial crisis (financial innovation and securitization; heterogeneity of agents, markets and regulatory frameworks) are, by and large, overlooked by standard macroeconomic models which have failed to forecast the advent of the crisis and are unable to restore economic growth. Agent-based and computational models depart from the representative agent paradigm, thereby introducing heterogeneity of agents’ characteristics and behavior, and allowing for markets that do not clear. These models are better equipped to analyze the salient features of out-of-equilibrium paths and provide novel insights on required economic policy during crises. This volume gathers contributions of leading scholars working on agent-based and computational models. It demonstrates how these models have reached the point where they can guide macro- and micro-economic policy. Auteur(s) : Edited by Jean-Luc Gaffard and Mauro Napoletano with contributions of Mario Amendola, Quamrul Ashraf, Zakaria Babutsidze, Sylvain Barde, Tommaso Ciarli, Silvano Cincotti, Giovanni Dosi, Domenico Delli Gatti, Corrado Di Guilmi, Giorgio Fagiolo, Mauro Gallegati, Boris Gershman, Eric Guerci, Peter Howitt, Alan Kirman, Simone Landini, Fabrizio Patriarca, Andreas Pyka, Marco Raberto, Andrea Roventini, Alessandro Sapio, Francesco Saraceno, Pier Paolo Saviotti, Andrea Teglio and Francesco Vona.