- EAN13

- 9782919782864

- Éditeur

- Legitech

- Date de publication

- 29 juin 2021

- Collection

- PRECIS

- Nombre de pages

- 545

- Dimensions

- 24 x 16 x 2,3 cm

- Poids

- 732 g

- Langue

- fre

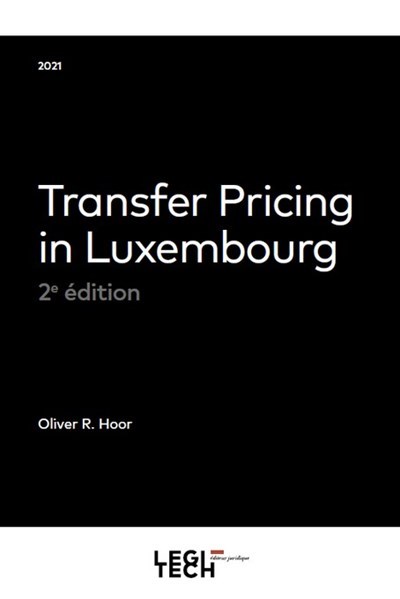

Transfer Pricing In Luxembourg

Oliver R. Hoor

Legitech

Prix public : 110,00 €

<p>DROIT LUXEMBOURGOIS</p><p>Over the last decades, Luxembourg has developed and cemented its position as a prime holding location and a major financial centre within Europe. Multinational enterprises and international investors alike use Luxembourg as a platform to manage and structure their business activities and investments.

Luxembourg companies may enter into diverse commercial and financial transactions with associated enterprises. The prices charged in regard to these controlled transactions are called transfer prices. For Luxembourg tax purposes, these prices have to adhere to the "arm's length principle".

The arm's length principle is the international transfer pricing standard that OECD member countries have agreed should be used for tax purposes by MNE groups and tax administrations. The arm`s length principle requires that the consideration for any transaction between related parties conform to the level that would have been agreed if the transaction were to have taken place between unrelated parties under comparable circumstances.

The arm's length principle is firmly ingrained in Luxembourg tax law and has been explicitly stated in article 56 of the Luxembourg Income Tax Law (LITL). In addition, several concepts and provisions under Luxembourg tax law require the arm's length standard to be respected by Luxembourg companies.

Over the last years, transfer pricing has become the hot topic in Luxembourg taxation in an environment that relies increasingly less on tax rulings. In the past, tax rulings were viewed as a way to provide certainty and to avoid risks when structuring investments or intra-group transactions. However, for a number of reasons this is no longer the case and transfer pricing documentation is more and more filling the gap as a tax risk management tool.

As a member of the OECD, Luxembourg adheres to the organization's Transfer Pricing Guidelines which reflect the consensus of OECD Member countries towards the application of the arm's length principle as provided in article 9(1) of the OECD Model Tax Convention. Notably, this provision is frequently included in tax treaties concluded by Luxembourg.

In 2020, a new chapter X has been added to the OECD Transfer Pricing Guidelines that provides guidance on transfer pricing aspects of financial transactions which are a common phenomenon in Luxembourg.

The OECD further released guidance on the transfer pricing implications of the COVID-19 pandemic. Indeed, as the political response around the globe in order to stop the spread of the virus (lockdowns, travel restrictions, etc.) results in an unprecedented economic downturn, this may also have an impact on the transfer pricing analysis and requires due consideration.

This book analyses all facets of Luxembourg transfer pricing rules and relevant guidance in the 2020 version of the OECD Guidelines. As such, it should enable readers to develop a sound understanding of transfer pricing in Luxembourg.</p>